Is a cash book sufficient to provide to the accountant for auditing?

What are cash flow records and accounting records?

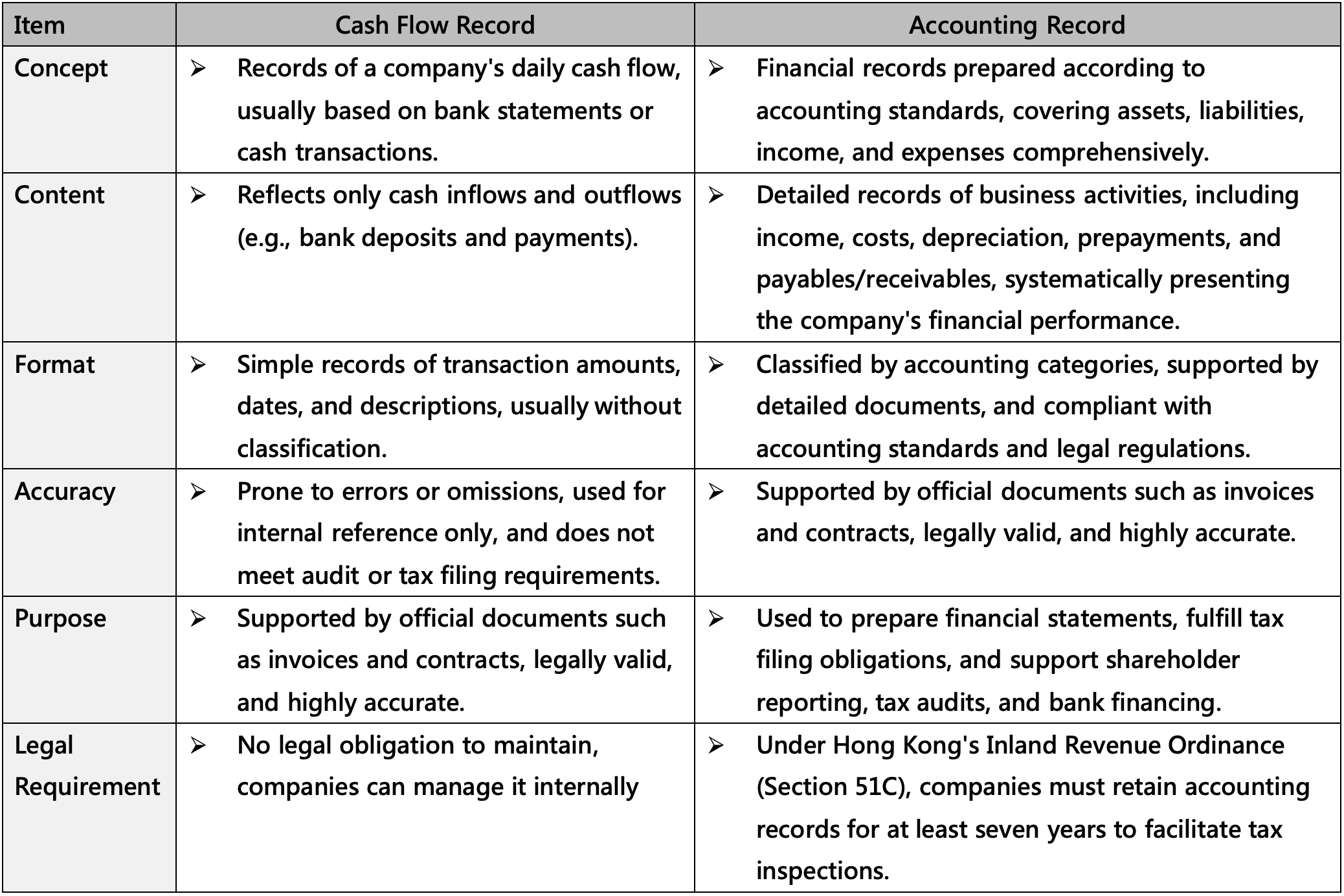

Here is a brief explanation highlighting the differences between cash flow records and accounting records: